Payroll management is a critical function for any business, ensuring that employees are paid accurately and on time. For UK businesses, selecting the right payroll software can be a daunting task given the myriad of options available. Among the choices, Capium Payroll has emerged as a popular option, particularly for small to medium-sized enterprises (SMEs) and accounting firms. This article provides a detailed pricing review of Capium Payroll, helping businesses make informed decisions when choosing payroll software.

Understanding Capium Payroll

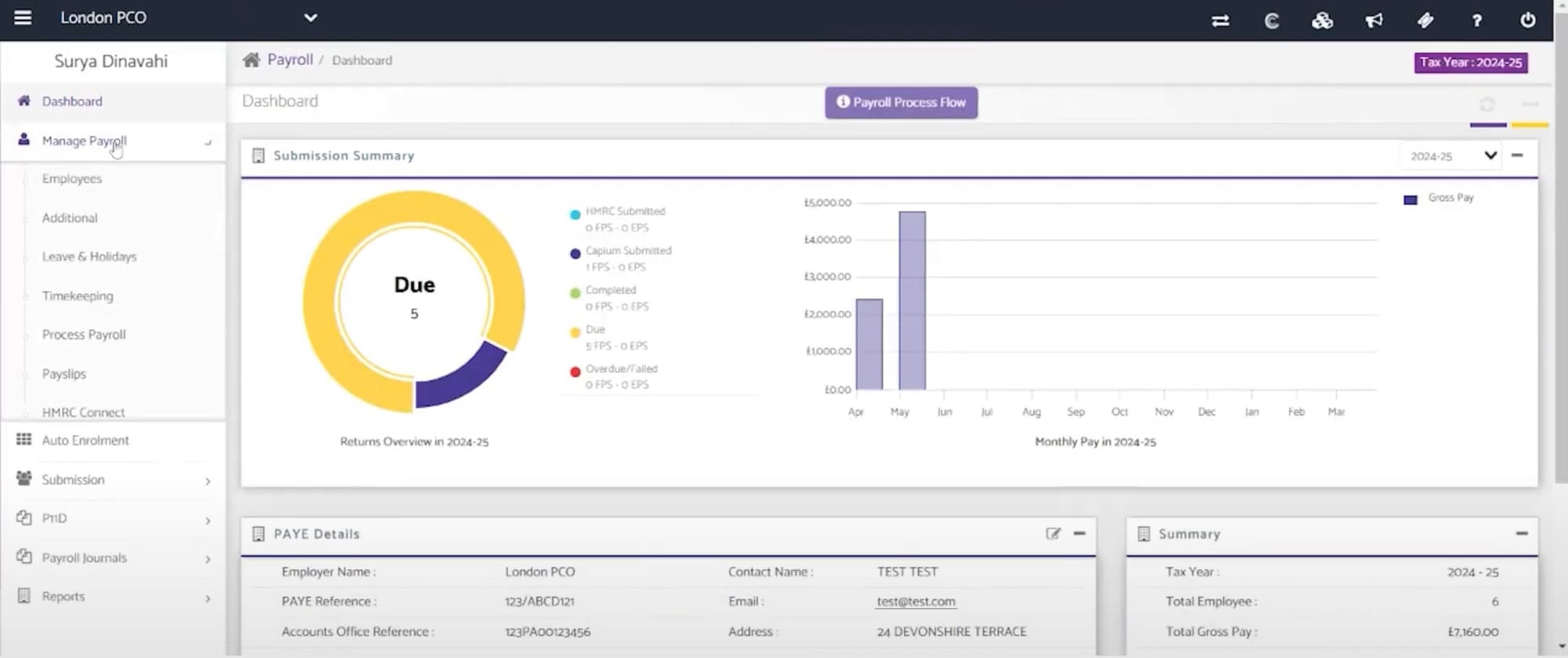

Capium is a cloud-based accounting and practice management software provider that offers a range of tools tailored for accountants and businesses. Capium Payroll is one of its key offerings, designed to simplify the payroll process by automating tasks, ensuring compliance with HMRC regulations, and providing comprehensive reporting features.

Key features of Capium Payroll

Before diving into pricing, it is essential to understand the core features that Capium Payroll offers. These include:

- Automated RTI Submissions: Capium Payroll supports Real-Time Information (RTI) submissions directly to HMRC, ensuring compliance with the latest regulations.

- Employee Self-Service: Employees can access their payslips, P60s, and other documents online, reducing administrative burden on HR teams.

- Pension Auto-Enrolment: The software facilitates auto-enrolment for pensions, which is crucial for businesses complying with the UK’s pension regulations.

- Flexible Pay Schedules: Capium allows for weekly, fortnightly, or monthly payroll runs, catering to different business needs.

- Comprehensive Reporting: Detailed payroll reports can be generated, providing insights into employee costs, tax obligations, and more.

- Integration with Capium Accounting: Seamless integration with Capium’s other modules, such as accounting and practice management, for holistic business management.

Capium Payroll pricing list

Here’s a pricing data table for Capium Payroll, which reflects typical offerings based on the number of employees. Keep in mind that these prices are indicative and may vary depending on specific business requirements, promotions, or customised agreements directly with Capium.

| Pricing Model | Number of Employees | Monthly Cost (£) | Features Included |

|---|---|---|---|

| Pay-as-you-go | 1-5 | £10 | Basic payroll processing, automated RTI submissions, employee self-service portal |

| 6-20 | £20 | Basic payroll processing, automated RTI submissions, employee self-service portal | |

| 21-50 | £35 | Basic payroll processing, automated RTI submissions, employee self-service portal | |

| 51-100 | £60 | Basic payroll processing, automated RTI submissions, employee self-service portal | |

| Subscription | 1-10 | £25 | All basic features, plus pension auto-enrolment, comprehensive reporting, priority support |

| 11-30 | £50 | All basic features, plus pension auto-enrolment, comprehensive reporting, priority support | |

| 31-50 | £75 | All basic features, plus pension auto-enrolment, comprehensive reporting, priority support | |

| 51-100 | £100 | All basic features, plus pension auto-enrolment, comprehensive reporting, priority support | |

| Custom Pricing | 101+ | Custom | Tailored solutions including advanced features, volume discounts, bespoke support packages |

Capium Payroll pricing structure

Capium’s pricing model is designed to be flexible and scalable, accommodating the needs of different businesses. Unlike some payroll software providers that offer a flat fee, Capium uses a modular pricing system that allows users to pay based on the number of employees and the level of service required. This model ensures that smaller businesses are not overcharged while larger enterprises can access the features they need.

- Pay-as-you-go Model: Capium offers a pay-as-you-go pricing option, which is ideal for smaller firms or those with fluctuating payroll needs. This model allows businesses to pay based on the number of employees processed each month.

- Subscription Model: For businesses that prefer a more predictable cost structure, Capium offers a subscription-based model. Pricing under this model is tiered, based on the number of employees. The subscription model typically includes additional features and support options.

- Custom Pricing for Large Firms: For larger enterprises or accounting firms managing multiple clients, Capium offers custom pricing. This allows for tailored solutions that meet specific business needs, including volume discounts and bespoke support packages.

Comparing Capium Payroll with competitors

When evaluating Capium Payroll, it is important to compare it with other payroll solutions available in the UK market. Key competitors include Sage Payroll, Xero Payroll, and QuickBooks Payroll.

- Sage Payroll: A well-established name in accounting and payroll software, Sage offers robust features but at a higher price point. Sage’s pricing is generally higher than Capium, making Capium a more cost-effective option for SMEs.

- Xero Payroll: Xero offers seamless integration with its accounting software, similar to Capium. However, Xero’s payroll pricing is typically more expensive for smaller employee numbers, making Capium a more economical choice for smaller firms.

- QuickBooks Payroll: Known for its ease of use and integration with QuickBooks accounting software, QuickBooks Payroll is a strong competitor. However, Capium offers more flexibility in pricing and can be more cost-effective for businesses with specific needs.

Is Capium Payroll the right choice for your business?

Choosing the right payroll software depends on a business’s specific needs, including the number of employees, budget constraints, and integration requirements. Capium Payroll is particularly well-suited for:

- Small to Medium-Sized Businesses: Its flexible pricing model allows smaller businesses to manage costs effectively while still accessing powerful payroll features.

- Accounting Firms: Capium’s integration capabilities and scalable pricing make it an attractive option for accounting firms managing multiple clients.

- Businesses Looking for Compliance and Automation: With features such as automated RTI submissions and pension auto-enrolment, Capium ensures compliance with UK regulations.

Conclusion – Capium Payroll pricing review

Capium Payroll offers a versatile and cost-effective payroll solution for UK businesses. Its flexible pricing structure, comprehensive feature set, and integration capabilities make it a strong contender in the payroll software market.

For SMEs and accounting firms looking for a scalable and compliant payroll solution, Capium Payroll is certainly worth considering. By understanding your business’s needs and comparing available options, you can make an informed decision that supports your payroll management efficiently and economically.

For more, see our guide to payroll services costs. Or if you’d rather manage your own payroll, check our reviews of the best small business payroll software. Finally, for those on a tighter budget, see free payroll software.

Capium Payroll pricing FAQ

For small businesses with fewer than 10 employees, Capium Payroll offers a subscription model at a cost of £25 per month. This includes features such as basic payroll processing, automated RTI submissions, employee self-service, pension auto-enrolment, and comprehensive reporting.

Yes, Capium Payroll offers a pay-as-you-go option. The pricing for this model is based on the number of employees processed each month. For 1-5 employees, the cost is £10 per month. For 6-20 employees, the cost is £20 per month. As the number of employees increases, the monthly cost rises accordingly.

For a business with 30 employees, Capium Payroll offers a subscription plan costing £50 per month. This plan includes all standard features like automated RTI submissions, employee self-service, pension auto-enrolment, and priority support.

Capium Payroll offers custom pricing for companies with more than 100 employees. While specific prices can vary based on the exact number of employees and required features, businesses typically enter into tailored agreements that could include volume discounts and bespoke support packages.

The £75 per month subscription plan for Capium Payroll is designed for businesses with 31-50 employees. It includes all basic features such as payroll processing and automated RTI submissions, as well as advanced features like pension auto-enrolment, comprehensive reporting, and priority support.

Capium Payroll generally does not advertise setup fees, but costs can vary based on specific business needs and the complexity of payroll implementation. For precise information, businesses should contact Capium directly to discuss potential one-time setup costs or onboarding fees.

Yes, Capium Payroll pricing can be adjusted based on the volume of employees processed. For example, the pay-as-you-go model scales from £10 per month for 1-5 employees up to £60 per month for 51-100 employees. Custom pricing options are available for businesses with larger payroll needs, potentially offering volume discounts.

Accounting firms using Capium Payroll to manage multiple clients can benefit from custom pricing arrangements. These options typically start from the £100 per month range for 51-100 employees but can be adjusted based on the total number of employees processed across clients. Tailored plans can include additional features and support tailored to accounting firms’ needs.

Capium Payroll pricing is subject to change, typically reviewed annually. Users are notified of any changes to pricing through direct communication from Capium, ensuring transparency and allowing businesses to adjust their budgets accordingly. For current pricing details, businesses should consult directly with Capium representatives.

Capium Payroll often provides free trials or demos for potential customers. These trials allow businesses to explore the software’s features and capabilities before committing to a paid plan. For details on trial durations and available features, businesses should contact Capium directly.